At Mining Indaba, Rawbank confirms its role as leading banker to the Congolese mining industry

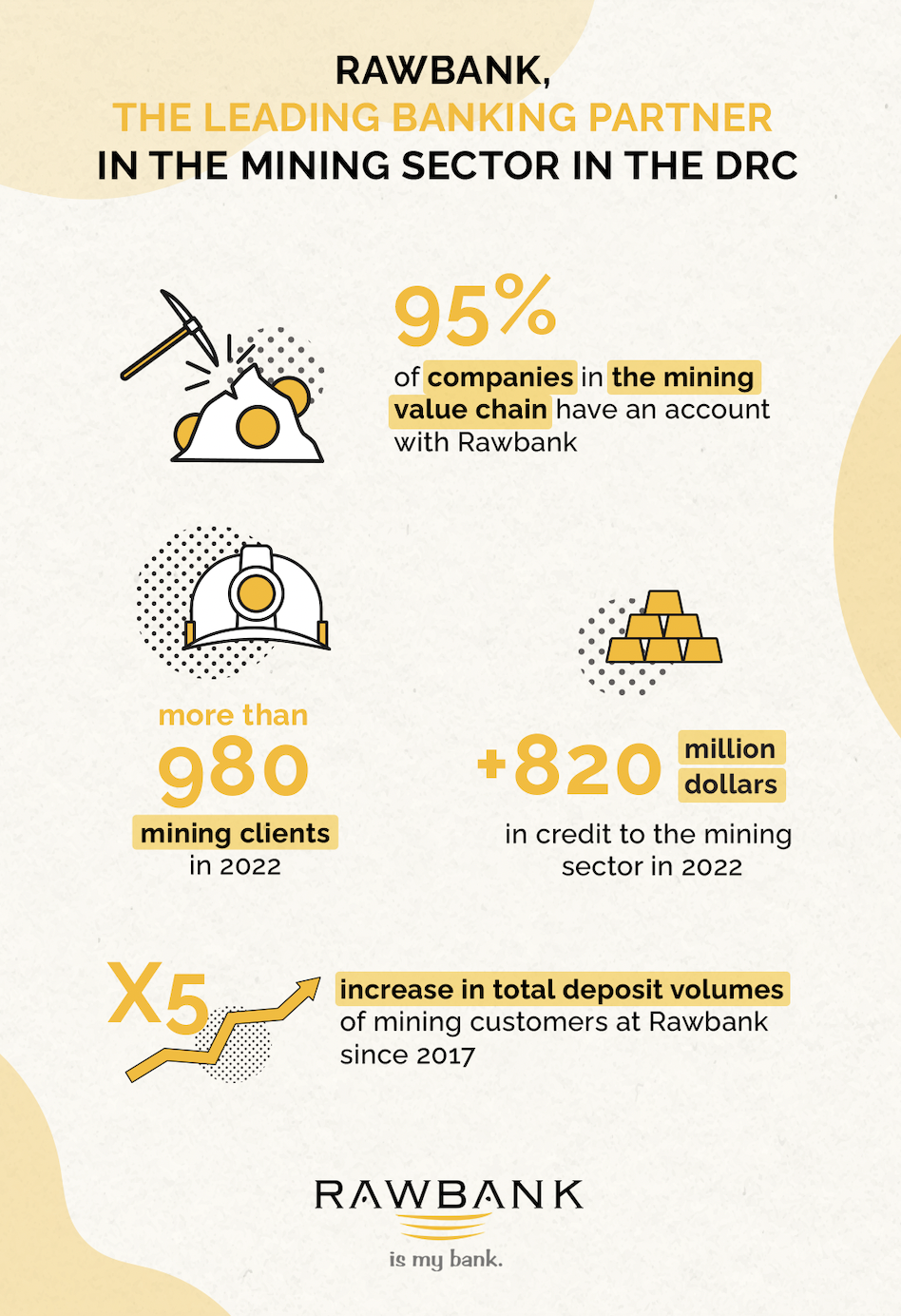

Participation at the Mining Indaba Forum in Cape Town highlights Rawbank’s role as the leading partner of the mining industry and its value chain in the Democratic Republic of Congo (DRC). The bank works with 95% of the businesses in the industry to provide solutions for their financing and operational needs and to optimise their cash management.

Since it started operating in 2002, Rawbank has supplied billions of dollars of credit to mining businesses operating in the DRC. These funds have allowed more than 980 businesses in the sector to access the means to build large-scale projects in Haut Katanga and Lualaba.

The growth of this financing has played a central role in the increase in the production of copper, gold and cobalt. Financing the DRC’s economy is Rawbank’s strategic priority.

In 2022, Rawbank supplied more than $820 million of credit to international and local mining companies, including processing and production businesses in copper and cobalt. These businesses, whose activity is cash-intensive, turn to Rawbank as the bank has the necessary liquidity and expertise to evaluate and meet their credit demands (fixed-term advances, credit lines or advances on invoices or orders).

The latest statistics from the Banque Centrale du Congo (BCC) show the dynamism of the country’s extractive industries. In 2022, mining companies in the DRC produced:

- 111,309 tonnes of cobalt versus 93,144 in 2021, an increase of more than 19%;

- 2,359,824 tonnes of copper versus 1,802,897 tonnes in 2021, an increase of more than 30%;

- 17,742,000 carats of diamonds versus 12,179,000 in 2021, an increase of more than 45%.

The sector’s dynamic performance, bolstered by higher raw material prices, has led over the last five years to the total volume of deposits by mining clients with Rawbank increasing more than five-fold.

In his appearance on DRC Breakfast, the bank’s commercial director Mr. Etienne Mabunda insisted on the importance of putting in place solutions to facilitate the operations of businesses in the sector. These solutions include Optimus a secure Web platform which facilitates exchange declarations linked to import- export operations for goods, services and capital transfers. Further examples are Rawbank Online and SIOP, which allow automated management of transactions directly from an information system, without any intervention from the bank.

The decision-makers present at Mining Indaba saluted Rawbank’s recent launch of a trading room meeting international standards allowing the bank to offer one of its mining clients the oppor- tunity to meet their financing needs (on this occasion $10 million) on the local money market. The execution of this first operation allows the bank to now offer its clients an alternative source of financing.

About RAWBANK

For 20 years, Rawbank has supported the development of the Congolese economy. The bank offers modern products and services to more than 500,000 corporate, SME and individual clients. These are provided via a network of 100 sales points in 19 of the country’s provinces, notably Grand Katanga, Grand Kasaï, the two Kivus, l’Equateur and Kongo Central. This vast agency network is complemented by a representative office in Brussels and 240 automatic cash dispensers. With a staff of more than 1,800, Rawbank has a market share of more than 30%.

Solidity, profitability and durability are Rawbank’s priorities as its seeks to consolidate its growth strategy.

The bank’s work has been recognised with the African Bankers Award 2022 for best bank in the central Africa region, a Moody’s CAA 1 rating, and ISO/IEC 20000 and ISO/IEC 27001 certifications.

Partners who have put their confidence in RAWBANK include the IFC, BAD, TDB, BADEA, Shelter Africa and AGF.

Live News

-

Africa’s ‘Buy Now, Pay Later’ Market to Triple to $16.8 Billion by 2031, Report Says

02:56

02:56

-

Egypt Plans $4 Billion Refinery Investment to Raise Output, Cut Fuel Imports

02:52

02:52

-

Five banks back CFA41bn financing for Grand-Zambi iron project

19:56

19:56

-

Land clearance delays threaten Yaoundé north bypass progress in 2026

19:46

19:46

-

Cameroon customs target CFA95bn in February, led by Douala and Kribi

19:33

19:33

-

Cameroon banks eye CFA42bn to back Nachtigal power payments

19:20

19:20

-

With Lemonade Payments, Mark Machiri Kihara Leverages Fintech to Simplify African Payments

19:04

19:04

-

Nigeria Tackles Drug Inflation With New Bulk Buying Agency

19:03

19:03

-

Danyi 1 Municipality Unveils Tourism Plan to Drive Growth

18:52

18:52

-

Liberia Plans Equity Stakes in Mines as Part of Code Overhaul

18:50

18:50

Absa Kenya hires M-PESA’s Sitoyo Lopokoiyit, signalling a shift from branch banking to a telecom-s...

Ziidi Trader enables NSE share trading via M-Pesa M-Pesa revenue rose 15.2% to 161.1 billio...

MTN Group has no official presence in the Democratic Republic of Congo, where the mobile market is d...

Ghana has 50,000 tonnes unsold cocoa at ports Cocoa prices fell from $13,000 to around ...

This week in Africa, Africa CDC is stepping up its drive for health sovereignty, building new partne...

The fast-growing installment payment market is set to expand sharply across the continent, even as stricter licensing and compliance rules reshape...

Egypt to invest $4 billion upgrading six refineries Plan aims to boost capacity, cut fuel imports Output lags 840,000 bpd capacity, driving...

The federal government signed a memorandum on Feb. 16, 2026 to establish Medipool as a national group purchasing organization for...

Liberia expects to finalize a revised mining code within three months, according to Mines Minister Matenokay Tingban. The government plans to allow a...

“Dao” ranks among the three films in official competition at the 76th Berlinale and marks Alain Gomis’ second bid for the Golden Bear. The film...

Fort Jesus is a fortress located in Mombasa, on Kenya’s coastline, at the entrance to the natural harbor that long made the city a hub of trade in the...